Can we make money timing the market?

Most investors have heard a story about someone who trades and makes money getting in and out of stocks, currencies, crypto or whatever is the current trend.

There are also many hedge funds and fund managers who also claim to have “inside knowledge” or “rare skill” to be able to profit from this technique.

It is tempting and perhaps it looks obvious, so why don’t we recommend this strategy?

Why don’t we do it for our clients? Why don’t we think you should do it?

Investing is a serious business, not a game.

When we look at managing money, we take it seriously and understand our responsibility as a fiduciary. This is not a game, a gamble or trial run. So, we are only going to implement strategies that have evidence supporting that they will add value for clients. We want to create certainty and give clients comfort that they will get good performance, but never lose their money.

Many brokers and advisers, dare I say, don’t behave in this way and will espouse their ability to time markets or pick stocks, when in fact they have no data to support this claim. It’s just a sales technique. Sorry, but that is just the facts.

Why do we say this?

There is now decades and decades of data and research illustrating that market timing is simply not a smart way to invest.

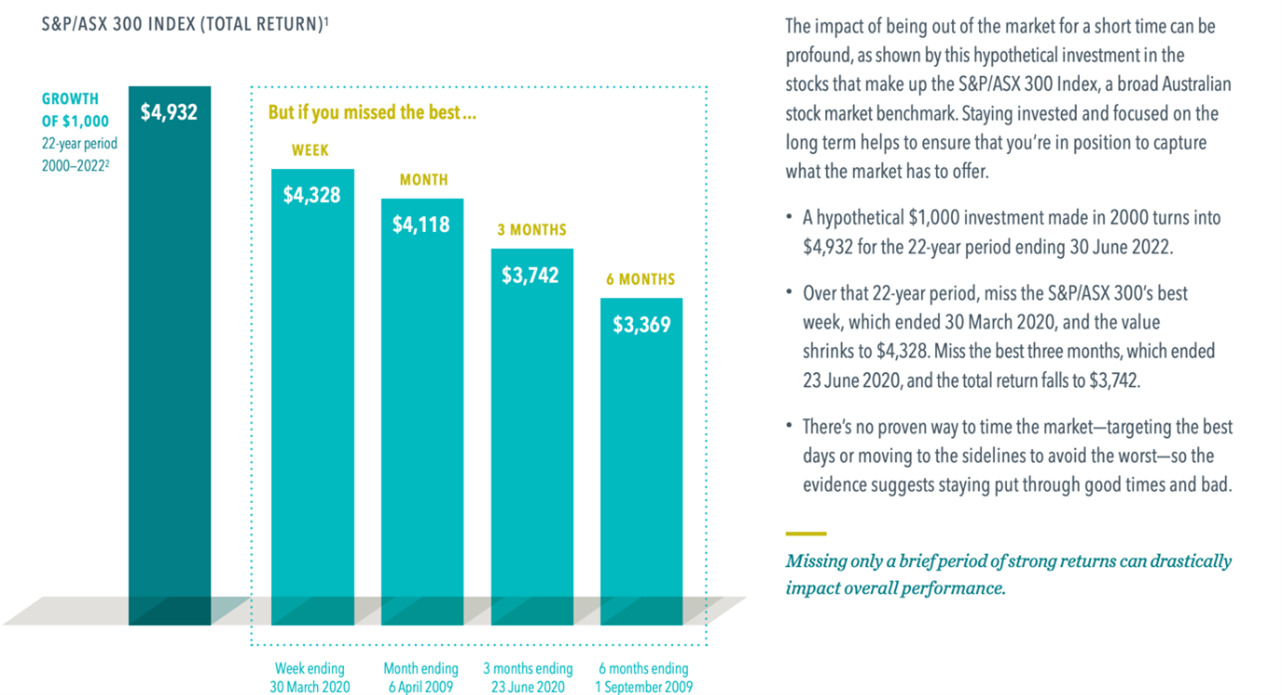

The chart and research below from Dimensional Fund Advisers illustrate this point:

Reading the data, the evidence shows that if you try and time the market and miss a week, a month, a few months or more, your returns are drastically reduced.

So why do hedged funds and the like say they can do it?

There are huge fees charged by managers who try to pick stocks and markets, often over 2%.

Research conducted by Standard and Poor updated quarterly illustrates that the chance of success of these fund managers that try to pick stocks or markets is slim. In fact, its frighteningly terrible.

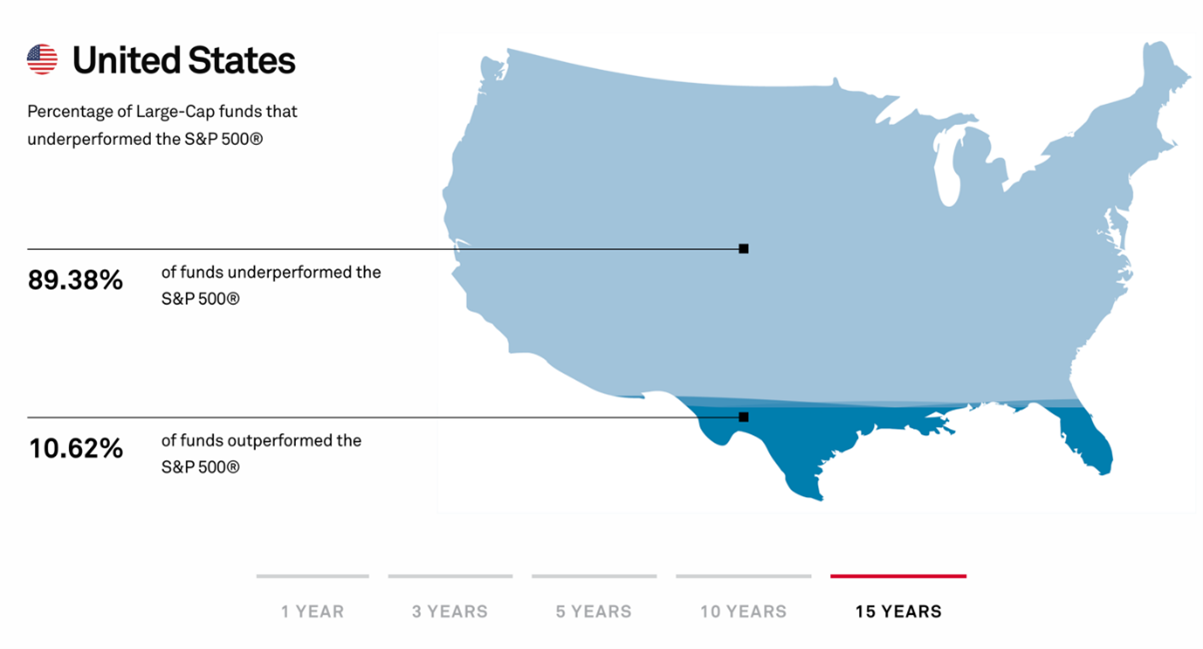

Here is the 15-year data from standard and poor’s:

SPIVA Data – Scorecard Results

This data shows that in just large-cap funds that use the S&P 500 index as a benchmark, 89.38% of those funds underperformed the S&P 500 over a 15-year period.

Now, remember all the managers from 15 years ago told their investors that they could beat the market due to their superior skill, knowledge, or system.

So, with only 10% achieving this, what is the chance of success for an individual investor? How can an investor try and pick the 10% that do outperform? It would be statistically almost impossible.

The chances are even slimmer because some funds from 15-years ago that underperformed disappear, merge or the manager changes. Many research papers end up with a conclusion that the chance of success is under 1% over time using managers that promise to be able to outperform using these techniques.

Is that a risk worth taking?

Ok then why do so many people still use these managers? Why do brokers recommend them?

Brokers and advisers recommend them because they get paid too, are gamblers, or are stupid. Yes blunt, but you would have to agree if you read the research. Some of these advisers are listed as top advisers in the country, yet they blatantly recommend funds that have less than 1% chance of success. Why?

The funds themselves are very good at marketing. They put on big lunches, wine and dine and sponsor a lot of adviser events. It still doesn’t make sense to me since the adviser is meant to be working for you. So, they are either conflicted, or just stupid.

A good example in Australia is Magellan. The star manager was marketed as a guru and they advertised everywhere, so people started to believe their story. They charged 1.35% when an international index fund can be purchased for 0.2% or lower!

Magellan did outperform for a few years, but they came crashing down, hard, eroding investors wealth. It’s not a great story for investors but a good one for the Magellan team – they cashed in … on your money! And the adviser that recommended them will just recommend the next best manger now, and the cycle continues. The loser is the client.

So, markets are down, managers can’t do anything – is it all a bit pointless?

No – you can achieve amazing investment results without having to pick a star manager, time markets or invest in fads. There is a suite of investments and advisers that are very smart and put clients first. You deserve the truth and a solution that puts you first. It is your money after all.

Scientiam provides you with a choice of sensible portfolios that use science, rather than guesswork. We believe in educating our investors, rather than keeping them in the dark, so we provide blogs, articles, market updates and a variety of resources to help you become informed.